Nolvadex for sale uk for sales tax rate

Looking to buy Nolvadex in the UK? Look no further! We offer competitive prices on Nolvadex and provide a wide range of benefits for our customers. Not only do we provide high-quality Nolvadex, but we also offer valuable information on sales tax rates and the advantages that come with purchasing from us.

Competitive Prices: At our online store, you can find Nolvadex at affordable prices. We understand the importance of cost-effective solutions for your health needs, and we are committed to providing the best value for your money.

High-Quality Products: Your health is our priority, and that's why we source Nolvadex from trusted manufacturers. Rest assured, when you buy Nolvadex from us, you are getting a genuine, reliable product that can help you on your journey to wellness.

Sales Tax Rates: We understand that sales tax can be a concern for many customers. That's why we have thoroughly researched sales tax rates in the UK to provide you with accurate and up-to-date information. We believe in transparency and want you to have a clear understanding of what to expect when making a purchase.

Benefits of Purchasing from Us: When you choose us as your Nolvadex supplier, you gain access to a host of benefits. We offer discreet packaging for your privacy, fast and reliable shipping options to get your product to you quickly, and exceptional customer service to assist you every step of the way.

Buy Nolvadex from us today and experience the convenience, affordability, and peace of mind that comes with our reliable service. Choose us as your trusted source for Nolvadex, and let us help you on your path to better health.

"The best prices, top-quality products, and comprehensive information on sales tax rates – that's what sets us apart as the leading Nolvadex supplier in the UK."

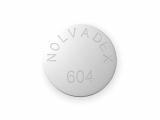

About Nolvadex

Nolvadex, also known as tamoxifen citrate, is a medication that belongs to a class of drugs called selective estrogen receptor modulators (SERMs). It is commonly used in the treatment of breast cancer, as it helps to block the effects of estrogen on breast tissue. Nolvadex is often prescribed to women who have been diagnosed with hormone receptor-positive breast cancer, as well as to individuals at high risk of developing breast cancer.

Nolvadex works by binding to estrogen receptors in the breast cells, blocking the estrogen from attaching and stimulating the growth of cancer cells. This helps to slow down the progression of the disease and can be used both before and after surgery or radiation therapy. Additionally, Nolvadex may also be used for other conditions such as infertility in women with polycystic ovary syndrome (PCOS) or as a preventive measure for individuals with a family history of breast cancer.

When taking Nolvadex, it's important to follow the prescribed dosage and recommendations given by your healthcare provider. The medication is usually taken orally once or twice a day with or without food. It's essential to continue taking Nolvadex for the prescribed duration, even if you start feeling better, as stopping the medication prematurely may reduce its effectiveness.

As with any medication, Nolvadex may cause side effects. Common side effects include hot flashes, vaginal discharge, irregular menstrual periods, and headaches. However, not everyone experiences these side effects, and they may vary from person to person. If you experience any severe or persistent side effects, it's important to consult your doctor for further guidance.

In conclusion, Nolvadex is a medication commonly used in the treatment of breast cancer and as a preventive measure for high-risk individuals. It works by blocking the effects of estrogen and slowing down the growth of cancer cells. If you have been prescribed Nolvadex, it's crucial to follow the recommended dosage and consult your healthcare provider for any concerns or side effects.

Sales Tax Rates

Understanding Sales Tax

Sales tax is a consumption tax that is imposed on the sale of goods and services. The rates of sales tax vary from country to country, and even within different states or regions of a country. It is important for businesses and individuals to understand the sales tax rates in order to properly calculate the taxes to be paid and to ensure compliance with the law.

Benefits of Understanding Sales Tax Rates

Having a good understanding of sales tax rates can benefit both businesses and consumers. For businesses, knowing the sales tax rates in different jurisdictions can help them accurately price their products or services and understand the impact of taxes on their bottom line.

For consumers, understanding sales tax rates can help them make informed purchasing decisions, as it allows them to compare prices and calculate the total cost of a product or service, including taxes.

Factors Affecting Sales Tax Rates

Several factors can affect sales tax rates. One of the main factors is the jurisdiction or location where the sale takes place. Different countries, states, and regions may have different tax rates. Additionally, the type of product or service being sold may also affect the sales tax rate.

Furthermore, some jurisdictions may have exemptions or reduced tax rates for certain goods or services. It is important to stay updated on any changes in the sales tax laws to ensure compliance and avoid any penalties or fines.

Calculating Sales Tax

Calculating sales tax involves multiplying the sales price of a product or service by the applicable tax rate. For example, if the sales tax rate is 10% and the price of a product is £100, the sales tax would be £10, making the total cost £110. However, it is important to note that some jurisdictions may have different methods of calculating sales tax, such as adding tax on top of the sales price or including tax in the sales price.

Conclusion

Understanding sales tax rates is essential for businesses and consumers alike. It helps ensure compliance with the law, allows for accurate pricing and cost calculation, and enables informed purchasing decisions. Keeping track of the sales tax rates in different jurisdictions and staying updated on any changes will contribute to successful financial management and business operations.

Tax Rates in the UK

Income Tax

The income tax system in the UK is progressive, meaning that individuals are taxed at different rates depending on their income. The basic rate of income tax is currently set at 20% for taxable income between £12,500 and £50,000. The higher rate, which is 40%, applies to taxable income between £50,001 and £150,000. For taxable income exceeding £150,000, individuals are subject to the additional rate of 45%. It is important to note that these rates may vary depending on the tax year and personal circumstances.

Value Added Tax (VAT)

VAT is a consumption tax that is applied to most goods and services in the UK. The standard rate of VAT is currently set at 20%. However, certain goods and services may qualify for a reduced rate of 5% or even be exempt from VAT altogether. Businesses that are registered for VAT are required to collect VAT from their customers and pay it to HM Revenue and Customs (HMRC) on a regular basis.

Capital Gains Tax

Capital gains tax applies to the profit made from selling or disposing of certain assets, such as property, shares, or business assets. The rates of capital gains tax vary depending on the individual's taxable income and the type of asset being sold. Currently, the basic rate of capital gains tax for individuals is 10%, while the higher rate is 20%. However, there are certain tax reliefs and exemptions available that may reduce or eliminate the capital gains tax liability.

Inheritance Tax

Inheritance tax is a tax that is paid on the estate of a deceased person. Currently, the inheritance tax rate is 40% on the value of the estate above the tax-free threshold, which is set at £325,000. However, certain exemptions and reliefs may apply, such as the spouse exemption or the nil-rate band, which allows individuals to pass on a certain amount of their estate tax-free. It is important to plan ahead and consider inheritance tax implications when creating a will or transferring assets.

Corporate Tax

Corporate tax is the tax that limited companies and other corporate entities are required to pay on their profits. The current rate of corporate tax in the UK is 19%, which is relatively low compared to other countries. However, certain companies, such as those operating in the oil and gas sector, may be subject to a higher rate of tax. It is important for businesses to understand their corporate tax obligations and take advantage of any available tax reliefs or incentives.

Benefits

1. Effective Treatment for Breast Cancer

Nolvadex is a medication that has been widely recognized for its effectiveness in the treatment of breast cancer. It works by blocking the effects of estrogen, a hormone that can promote the growth of breast cancer cells. By doing so, Nolvadex helps to reduce the risk of cancer recurrence and improve the chances of survival for patients with breast cancer.

2. Prevention of Gynecomastia

Gynecomastia, or the enlargement of breast tissue in males, can be an embarrassing and uncomfortable condition. Nolvadex can be used as a preventive measure for individuals who are at high risk of developing gynecomastia, such as bodybuilders who use anabolic steroids. By blocking the effects of estrogen, Nolvadex helps to reduce the likelihood of developing this condition and maintains a more masculine appearance.

3. Increased Testosterone Production

In addition to its anti-estrogen effects, Nolvadex has been shown to stimulate the production of testosterone in men. This is particularly beneficial for athletes and bodybuilders who may experience a decrease in testosterone levels due to intense training or the use of performance-enhancing substances. By increasing testosterone production, Nolvadex can help to enhance muscle growth, strength, and overall athletic performance.

4. Reduced Risk of Osteoporosis

Postmenopausal women are at an increased risk of developing osteoporosis, a condition characterized by weak and brittle bones. Nolvadex has been found to have a protective effect on bone density and can help to reduce the risk of osteoporosis in these women. By maintaining bone density, Nolvadex promotes overall bone health and reduces the likelihood of fractures and other complications.

5. Easy Availability and Competitive Prices in the UK

Nolvadex is readily available for purchase in the UK, making it convenient for individuals who require this medication. Furthermore, with the high sales tax rates in the UK, purchasing Nolvadex from local sources can be more cost-effective compared to buying it from international sellers. Taking advantage of the competitive prices within the UK can help individuals save money while still ensuring they have access to this important medication.

In conclusion, Nolvadex offers numerous benefits for individuals seeking effective treatment for breast cancer, preventive measures against gynecomastia, enhanced testosterone production, and reduced risk of osteoporosis. With its easy availability and competitive prices in the UK, individuals can access this medication conveniently and cost-effectively.

Medical Benefits of Nolvadex

1. Prevention and Treatment of Breast Cancer

Nolvadex, also known as tamoxifen, is a medication commonly used to prevent and treat breast cancer. It works by blocking the effects of estrogen, a hormone that can stimulate the growth of breast cancer cells. By doing so, Nolvadex reduces the risk of developing breast cancer in high-risk individuals and helps prevent the recurrence of breast cancer in those who have already been treated for the disease.

2. Treatment of Infertility

In addition to its anti-cancer effects, Nolvadex is also used as a treatment for infertility in women. It can help stimulate the production of certain hormones that are necessary for ovulation to occur. This can be particularly beneficial for women who have irregular menstrual cycles or who have been diagnosed with polycystic ovary syndrome (PCOS).

3. Reduction of Gynecomastia

Nolvadex can also be used to reduce or prevent the development of gynecomastia, a condition characterized by the enlargement of male breast tissue. This can occur as a side effect of certain medications or as a result of hormonal imbalances. Nolvadex works by blocking the effects of estrogen in the body, which can help reduce the size of existing breast tissue and prevent further enlargement.

4. Protection Against Osteoporosis

Another potential medical benefit of Nolvadex is its ability to protect against osteoporosis, a condition characterized by weak and brittle bones. Estrogen plays a key role in maintaining bone density, and a decrease in estrogen levels can lead to an increased risk of osteoporosis. By blocking the effects of estrogen, Nolvadex can help maintain bone health and reduce the risk of fractures.

5. Adjunct Treatment for Bipolar Disorder

While primarily known for its use in cancer treatment and women's health, Nolvadex has also shown potential as an adjunct treatment for bipolar disorder. Some studies have found that Nolvadex may help stabilize mood and reduce symptoms of depression and mania in individuals with bipolar disorder. However, further research is needed to fully understand its effectiveness in this area.

In conclusion, Nolvadex offers a range of medical benefits beyond its primary use in cancer treatment. From preventing and treating breast cancer to assisting with fertility and protecting against osteoporosis, Nolvadex is a versatile medication with numerous applications in the field of healthcare.

Financial Benefits of Buying in the UK

1. Lower Sales Tax Rates

In the UK, the sales tax, also known as Value Added Tax (VAT), is generally lower compared to many other countries. This means that when you buy goods or services in the UK, you'll likely pay less in sales tax compared to purchasing the same items in other countries. The lower tax rate can help you save money and make your purchases more affordable.

2. Tax-Free Shopping for Non-EU Residents

If you are a non-EU resident, you may be eligible for tax-free shopping in the UK. This means that you can claim a refund of the VAT paid on eligible goods purchased during your visit. By taking advantage of this benefit, you can enjoy further savings on your purchases in the UK.

3. Duty-Free Limits for Travelers

When visiting the UK, there are duty-free limits for travelers that allow you to bring in certain goods without paying customs duties. These limits vary depending on the type of goods and your mode of travel, but they can provide additional savings on your purchases. Check the current duty-free allowances to ensure you stay within the set limits and maximize your financial benefits.

4. Competitive Market Prices

The UK has a competitive market with a wide range of options and prices for goods and services. This competition among businesses can lead to lower prices and better deals for consumers. By buying in the UK, you can take advantage of the competitive market and potentially find lower prices compared to other countries.

5. Strong Currency Exchange Rates

If you are buying in the UK with a foreign currency, favorable exchange rates can further contribute to the financial benefits. A strong currency exchange rate means that you can get more value for your money when converting it to UK pounds. This can help you stretch your budget and potentially save even more on your purchases.

Overall, buying in the UK can offer several financial benefits, including lower sales tax rates, tax-free shopping for non-EU residents, duty-free limits for travelers, competitive market prices, and strong currency exchange rates. Whether you're a local or a visitor, these advantages make the UK an attractive destination for shopping and finding good deals.

Follow us on Twitter @Pharmaceuticals #Pharmacy

Subscribe on YouTube @PharmaceuticalsYouTube

Be the first to comment on "Nolvadex for sale uk for sales tax rate"