Retail pharmacy revenue cycle

The revenue cycle is a critical component of the retail pharmacy business. It encompasses the entire process of generating income from the sale of pharmaceutical products and services. Having a comprehensive understanding of the revenue cycle is essential for the success of any retail pharmacy.

Procurement and Inventory Management:

One of the initial stages of the revenue cycle involves procurement and inventory management. This includes sourcing and purchasing pharmaceutical products from suppliers and maintaining an adequate stock of inventory to meet customer demand. Effective procurement and inventory management strategies ensure that the pharmacy can offer a wide range of products while minimizing costs and maximizing profitability.

It is crucial for a retail pharmacy to establish relationships with reliable suppliers in order to ensure the availability of high-quality pharmaceutical products.

Prescription Processing:

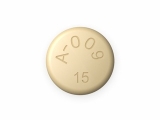

Prescription processing is a key step in the revenue cycle. This involves receiving prescriptions from customers, verifying their authenticity and accuracy, and preparing the medications for dispensing. Efficient prescription processing helps in streamlining the operations of the retail pharmacy and ensuring prompt and accurate service to customers.

Investing in advanced pharmacy management software can greatly enhance the prescription processing efficiency, minimizing errors and reducing wait times.

Dispensing and Patient Counseling:

Dispensing medications and providing patient counseling are crucial revenue-generating activities for a retail pharmacy. Pharmacists play a vital role in ensuring the safe and effective use of medications by patients. They provide important information on dosage instructions, potential side effects, and drug interactions.

Pharmacists should also take the opportunity to advise customers on lifestyle modifications, adherence to treatment plans, and the importance of timely refills, which can contribute to maintaining a steady revenue stream.

Claim Submission and Reimbursement:

Submitting claims to insurance companies and negotiating reimbursement rates is an integral part of the revenue cycle. Pharmacies need to ensure accurate and timely claim submission to optimize revenue and minimize payment delays. This often requires staying updated on ever-changing insurance policies and regulations.

The availability of automated claim submission systems simplifies the reimbursement process and improves accuracy, ensuring that the pharmacy receives appropriate compensation for services rendered.

Customer Service and Loyalty:

Customer service and building customer loyalty are crucial for sustaining revenue in the retail pharmacy business. Providing exceptional customer service, including personal attention, friendly and approachable staff, and convenient services, can lead to increased customer satisfaction and loyalty.

Investing in customer loyalty programs and offering additional services such as medication synchronization and medication therapy management can help retain customers and drive revenue growth.

In conclusion, understanding the revenue cycle in retail pharmacy is essential for optimizing profitability and ensuring long-term success. By focusing on effective procurement and inventory management, efficient prescription processing, quality dispensing and counseling, accurate claim submission and reimbursement, and exceptional customer service, retail pharmacies can thrive in a competitive market.

The Importance of Revenue Cycle in Retail Pharmacy

Efficient Financial Management

Managing the revenue cycle is crucial for retail pharmacies to ensure efficient financial management. It involves monitoring and tracking all financial transactions, including sales, reimbursements, and expenses. By effectively managing the revenue cycle, pharmacies can identify areas for improvement, streamline processes, and make informed decisions that can ultimately lead to increased profitability.

Enhanced Cash Flow

A well-managed revenue cycle can significantly impact a retail pharmacy's cash flow. By accurately and timely billing for products and services, pharmacies can efficiently collect payments and reduce outstanding accounts receivable. This can lead to improved cash flow, which is essential for meeting expenses, replenishing inventory, and investing in growth opportunities.

Compliance and Risk Management

The revenue cycle management also plays a vital role in ensuring compliance with regulations and minimizing financial risks. Retail pharmacies must adhere to strict billing and coding guidelines to avoid penalties and legal disputes. Effective revenue cycle management includes regular audits and reviews to identify any potential compliance issues or areas of risk, allowing pharmacies to take corrective actions and prevent potential legal and financial consequences.

Improved Patient Experience

An efficient revenue cycle can also have a positive impact on the overall patient experience in a retail pharmacy. By streamlining billing and insurance processes, pharmacies can minimize wait times and paperwork for patients. This can create a more convenient and seamless experience, improving patient satisfaction and loyalty. Additionally, accurate and transparent financial transactions can build trust and confidence among patients, enhancing their overall perception of the pharmacy.

Strategic Decision-Making

Effective revenue cycle management provides retail pharmacies with valuable data and insights that can inform strategic decision-making. By analyzing financial performance metrics, pharmacies can identify trends, patterns, and areas of potential growth. This information can help pharmacies optimize pricing strategies, identify cost-saving opportunities, and allocate resources effectively, ultimately leading to improved profitability and long-term success.

Understanding the Retail Pharmacy Industry

The Retail Pharmacy Industry: An Overview

The retail pharmacy industry is a vital component of the healthcare sector, providing essential medications and healthcare products to individuals in need. With numerous pharmacies operating across the country, this industry plays a crucial role in ensuring the accessibility and availability of medications to the public.

The Role of Retail Pharmacies

Retail pharmacies serve as a bridge between patients and healthcare providers. They dispense prescriptions, provide over-the-counter medications, and offer healthcare advice to customers. These pharmacies are often located in convenient locations, making it easier for individuals to access necessary medications and health-related products.

Challenges and Opportunities in the Retail Pharmacy Industry

The retail pharmacy industry faces various challenges and opportunities. Some challenges include increasing competition, rising healthcare costs, and regulatory requirements. However, technological advancements and the growing demand for personalized care present opportunities for retail pharmacies to innovate and improve the quality of healthcare services they offer.

The Importance of Customer Service

Customer service plays a crucial role in shaping the success of retail pharmacies. Providing personalized and attentive care to customers not only helps build trust and loyalty, but it also contributes to better health outcomes. Retail pharmacies should prioritize training their staff to deliver excellent customer service and foster positive relationships with customers.

Ensuring Patient Safety and Confidentiality

Patient safety and confidentiality are paramount in the retail pharmacy industry. Pharmacies must adhere to strict regulations and protocols to ensure the accuracy and security of medication distribution. Implementing robust systems and processes, such as double-checking prescriptions and maintaining secure patient records, helps protect patient safety and confidentiality.

- Pharmacy Benefit Management: Retail pharmacies often work with pharmacy benefit managers to ensure efficient reimbursement and medication access for patients.

- Collaboration with Healthcare Providers: Building strong relationships with healthcare providers allows retail pharmacies to enhance patient care by coordinating medication management and monitoring.

- Promoting Health and Wellness: Retail pharmacies can go beyond dispensing medications by offering health screenings, immunizations, and wellness programs to support overall well-being.

Conclusion

The retail pharmacy industry is a critical component of the healthcare sector, providing essential medications, healthcare products, and services to the public. By understanding the industry's challenges and opportunities, prioritizing customer service, ensuring patient safety, and embracing innovation, retail pharmacies can continue to make a positive impact on the well-being of individuals and communities.

What is a Revenue Cycle?

A revenue cycle is the process that a retail pharmacy uses to generate income. It encompasses all the steps involved in providing products and services to customers and receiving payment for those transactions.

There are several key stages in the revenue cycle of a retail pharmacy. The first stage is when a customer makes a purchase. This can include buying prescription medications, over-the-counter drugs, or health and wellness products.

After the purchase is made, the pharmacy must process the transaction and record it in their system. This involves entering the details of the sale, such as the product name, quantity, price, and any applicable discounts or promotions.

Next, the pharmacy must submit a claim to the customer's insurance company or pharmacy benefit manager (PBM) for reimbursement. This step is crucial for ensuring that the pharmacy is properly compensated for the products and services they provide.

Once the claim is submitted, the pharmacy must wait for the insurance company or PBM to review and approve the claim. This process can take varying amounts of time, depending on the specific insurance plan and the complexity of the claim.

Once the claim is approved, the pharmacy will receive payment from the insurance company or PBM. This payment may come in the form of a direct deposit or a physical check.

In some cases, the customer may have a co-pay or deductible that they are responsible for paying out-of-pocket. The pharmacy must collect these payments from the customer and record them in their system.

Overall, the revenue cycle of a retail pharmacy involves a series of interconnected steps that ensure the pharmacy receives proper payment for the products and services they provide to customers. Effective management of the revenue cycle is essential for the financial success of a retail pharmacy.

Key Components of the Revenue Cycle in Retail Pharmacy

1. Prescription Processing

One of the key components of the revenue cycle in retail pharmacy is prescription processing. This involves receiving electronic or paper prescriptions from patients or healthcare providers, verifying the information, and entering it into the pharmacy's system. Accurate and efficient prescription processing is essential for ensuring proper billing and reimbursement.

Key tasks:

- Receiving prescriptions

- Verifying information

- Entering prescriptions into the system

2. Insurance Billing

Another important component of the revenue cycle is insurance billing. Once the prescription is processed, the pharmacy must submit a claim to the patient's insurance provider for reimbursement. This involves verifying insurance coverage, determining copayments or deductibles, and following the appropriate billing procedures to ensure timely payment.

Key tasks:

- Verifying insurance coverage

- Determining copayments or deductibles

- Submitting claims to insurance providers

3. Inventory Management

Effective inventory management is crucial for a retail pharmacy's revenue cycle. This involves monitoring stock levels, ordering medications and supplies, and managing expired or damaged products. By maintaining an optimal inventory, pharmacies can ensure they have the necessary drugs on hand to fulfill prescriptions, while minimizing the risk of overstocking and wasted expenses.

Key tasks:

- Monitoring stock levels

- Ordering medications and supplies

- Managing expired or damaged products

4. Patient Payment Collection

Collecting patient payments is an essential component of the revenue cycle in retail pharmacy. This involves collecting copayments, deductibles, or any other out-of-pocket expenses from patients at the time of service. It is important for pharmacies to have clear payment policies and processes in place to ensure timely and accurate payment collection.

Key tasks:

- Collecting copayments and deductibles

- Processing payments

- Providing receipts and documentation

5. Revenue Analysis and Reporting

Finally, revenue analysis and reporting are critical for understanding the financial performance of a retail pharmacy. This involves analyzing sales data, tracking revenue trends, and generating reports to identify areas of opportunity or improvement. By regularly reviewing revenue data, pharmacies can make informed decisions to optimize profitability and drive business growth.

Key tasks:

- Analyzing sales data

- Tracking revenue trends

- Generating reports

Benefits of Effective Revenue Cycle Management

1. Improved Cash Flow

Effective revenue cycle management allows retail pharmacies to optimize their cash flow by streamlining the billing and collection process. By implementing efficient billing and payment systems, pharmacies can ensure timely and accurate reimbursement for the products and services they provide.

2. Increased Revenue

Proper management of the revenue cycle can help retail pharmacies identify potential revenue leaks and take appropriate measures to maximize revenue. By identifying and addressing billing errors, denied claims, and underpayments, pharmacies can recover lost revenue and increase their overall financial performance.

3. Enhanced Patient Satisfaction

A well-managed revenue cycle ensures a smooth and efficient billing experience for patients. By providing transparent and accurate billing statements, retail pharmacies can improve patient satisfaction and loyalty. This, in turn, can lead to increased customer retention and referrals, contributing to the growth of the pharmacy business.

4. Optimal Inventory Management

By effectively managing the revenue cycle, retail pharmacies can gain insights into their sales data and inventory levels. This information can be used to make informed purchasing decisions and avoid overstocking or shortages. With optimal inventory management, pharmacies can minimize waste, reduce costs, and improve profitability.

5. Compliance with Regulations

Effective revenue cycle management ensures that retail pharmacies comply with regulatory requirements and industry standards. By implementing robust billing and coding practices, pharmacies can minimize the risk of audits, fines, and penalties. This not only protects the pharmacy's reputation but also helps maintain trust with patients and other stakeholders.

6. Efficient Workflow

An effective revenue cycle management system streamlines the workflow within a retail pharmacy. By automating repetitive tasks, reducing manual errors, and improving communication between departments, pharmacies can enhance operational efficiency and productivity. This allows pharmacists and staff to focus more on patient care, ultimately improving the quality of service provided.

7. Data-driven Decision Making

By maintaining accurate and up-to-date revenue cycle data, retail pharmacies can analyze trends, identify areas for improvement, and make data-driven decisions. This helps pharmacies optimize their business operations, allocate resources effectively, and identify new opportunities for growth.

Challenges in Revenue Cycle Management for Retail Pharmacies

1. Insurance Reimbursement

One of the major challenges in revenue cycle management for retail pharmacies is dealing with insurance reimbursement. Retail pharmacies often need to navigate complex insurance policies and guidelines to ensure they are properly reimbursed for the medications they dispense. This can involve time-consuming tasks such as verifying insurance coverage, obtaining prior authorization, and submitting claims. Delays or denials in reimbursement can significantly impact a pharmacy's revenue.

2. Changing Insurance Regulations

Another challenge for retail pharmacies is keeping up with the ever-changing landscape of insurance regulations. Insurance providers frequently update their policies, formularies, and reimbursement rates, which can be difficult for pharmacies to keep track of. Ensuring compliance with these regulations and adjusting billing practices accordingly is crucial for maintaining a smooth revenue cycle.

3. Prescription Adjudication Issues

Prescription adjudication, the process by which insurance claims are reviewed and approved, can also pose challenges for retail pharmacies. Errors or discrepancies in patient information, medication codes, or insurance information can result in claim rejections or delays in payment. Retail pharmacies need to have robust systems in place to verify and accurately submit prescription claims to minimize these issues.

4. High Volume of Cash Transactions

Retail pharmacies often handle a high volume of cash transactions, which can complicate revenue cycle management. Cash payments need to be accurately recorded, reconciled, and deposited, requiring additional time and resources. Implementing efficient cash management processes and systems is essential for effectively managing revenue in retail pharmacies.

5. Medication Pricing and Discounts

Determining medication pricing and managing discounts can also be a challenge for retail pharmacies. Pharmacies need to consider factors such as acquisition costs, insurance reimbursements, and market competition when pricing medications. Additionally, managing and applying various discounts, such as manufacturer rebates or pharmacy loyalty programs, can impact the revenue cycle.

Conclusion

Managing the revenue cycle in retail pharmacies comes with its own unique set of challenges. From dealing with insurance reimbursement and changing regulations to ensuring accurate prescription adjudication and handling cash transactions, pharmacies must have effective processes in place to optimize their revenue. By addressing these challenges head-on, retail pharmacies can enhance their financial performance and provide quality care to their patients.

Best Practices for Optimal Revenue Cycle Management in Retail Pharmacy

Streamline Prescription Processing

In order to optimize revenue cycle management in a retail pharmacy setting, it is essential to streamline the prescription processing system. This involves implementing efficient workflows and utilizing technology solutions such as electronic health records (EHR) and pharmacy management systems.

By streamlining prescription processing, retail pharmacies can improve accuracy and minimize errors, ultimately saving time and reducing costs.

Implement Effective Inventory Management

An important aspect of revenue cycle management in retail pharmacy is maintaining an effective inventory management system. This involves regular monitoring and tracking of medication stock levels, as well as implementing best practices for ordering, receiving, and storing medications.

With proper inventory management, retail pharmacies can avoid shortages, reduce wastage, and ensure that the right medications are available for customers, improving overall revenue generation.

Utilize Point-of-Sale (POS) Systems

Integrating point-of-sale (POS) systems into the revenue cycle management process can greatly enhance efficiency in retail pharmacies. These systems not only facilitate smooth transactions but also provide valuable data and analytics that can be used to identify sales trends, optimize pricing strategies, and improve customer experience.

By leveraging POS systems, retail pharmacies can effectively track and manage their finances, increase profitability, and drive revenue growth.

Optimize Insurance Claim Submission and Reimbursement Processes

Insurance claim submission and reimbursement processes play a crucial role in revenue cycle management for retail pharmacies. It is imperative to have robust systems and protocols in place to accurately submit claims, verify coverage, and expedite reimbursements from insurance providers.

By optimizing these processes, retail pharmacies can minimize claim denials, reduce payment delays, and ensure timely revenue collection, ultimately improving their financial performance.

Continuously Train and Educate Staff

Investing in the training and education of pharmacy staff is a vital component of effective revenue cycle management. Retail pharmacies should regularly provide their employees with comprehensive training on best practices, regulations, and industry updates.

By keeping the staff informed and updated, retail pharmacies can ensure consistent adherence to policies and procedures, reduce errors, and enhance efficiency in revenue cycle management.

Incorporating these best practices into revenue cycle management can greatly benefit retail pharmacies, helping them optimize financial processes, improve customer service, and drive sustainable growth.

Follow us on Twitter @Pharmaceuticals #Pharmacy

Subscribe on YouTube @PharmaceuticalsYouTube

Be the first to comment on "Retail pharmacy revenue cycle"